Sage Intacct Construction:

Built for builders, powered

by the cloud.

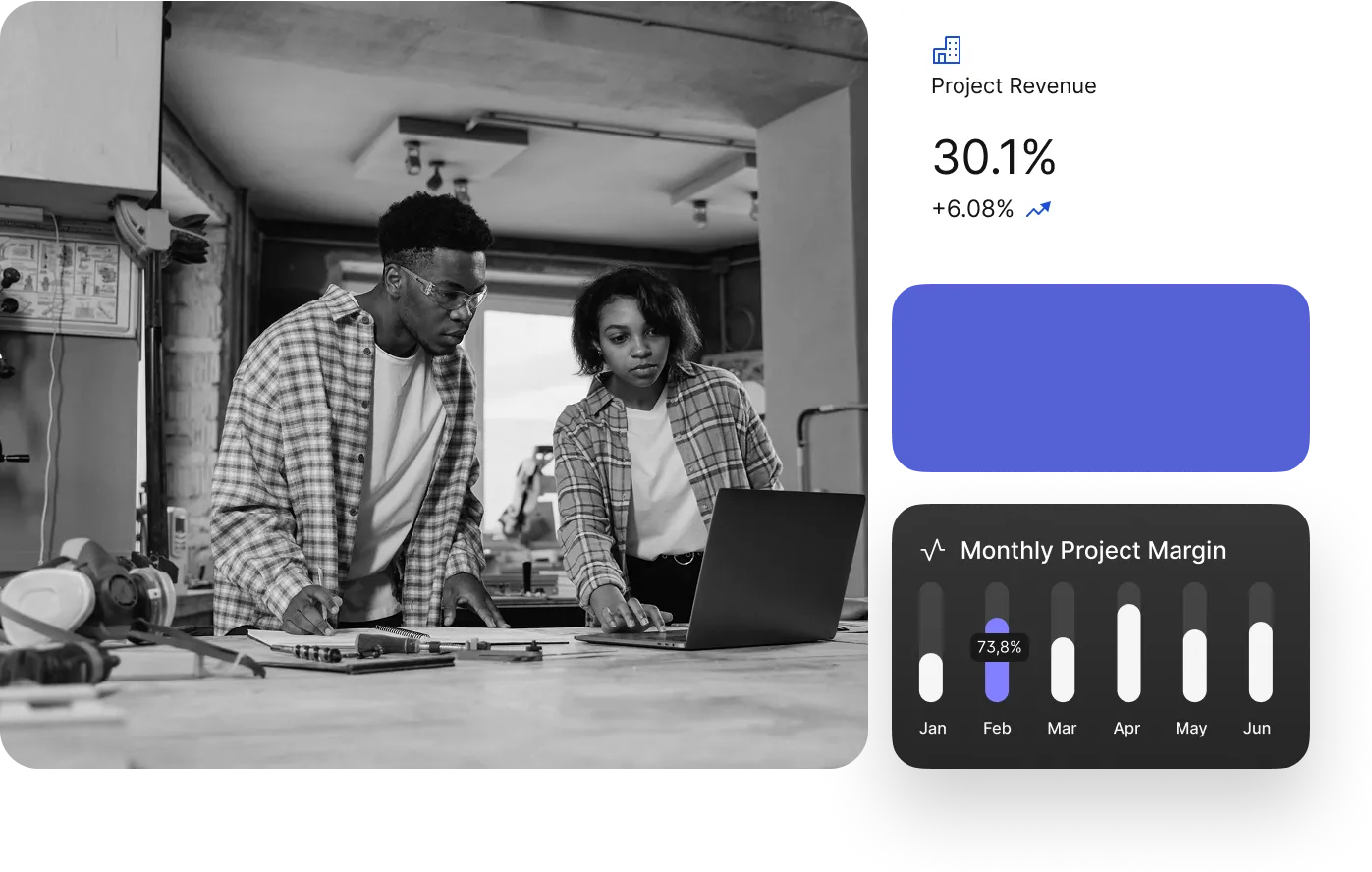

Sage Intact Benefits

Build Confidently

Eliminate business blind spots.

Simplify and automate busy work.

Thrive with cloud software built for construction.

The most complete cloud

construction software out there.

more efficient business — with tools that connect your people, projects, processes, and profits.

Pre-Construction

BidMatrix, and eTakeoff Dimension.

Win more business with AI-powered takeoffs

and smart bid analysis.

Operations

Sage Construction Management. Mobilize your team.

Eliminate double entry. Manage tasks, RFIs, submittals,

labor, and schedules from any device.

.jpg)

.png)

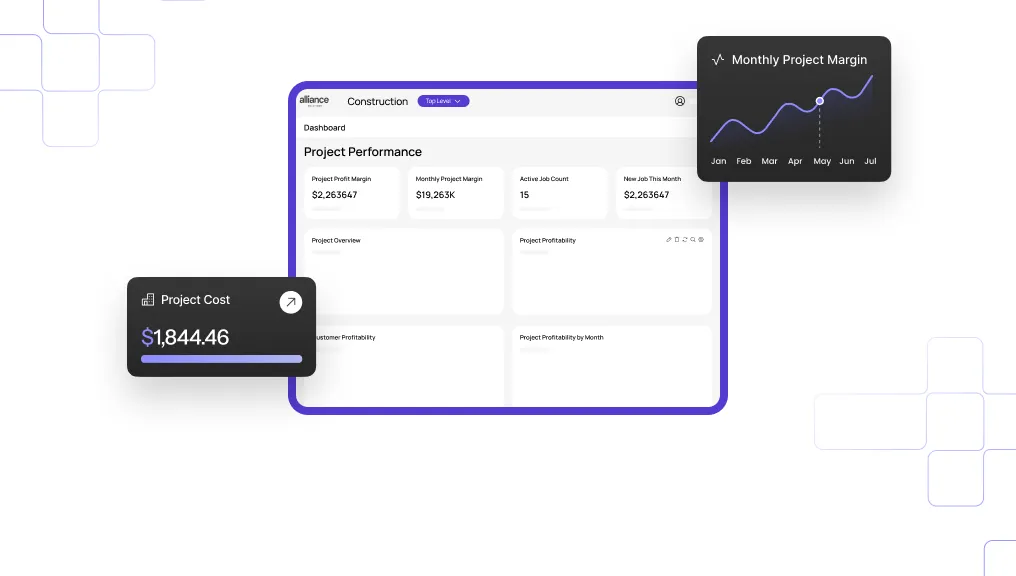

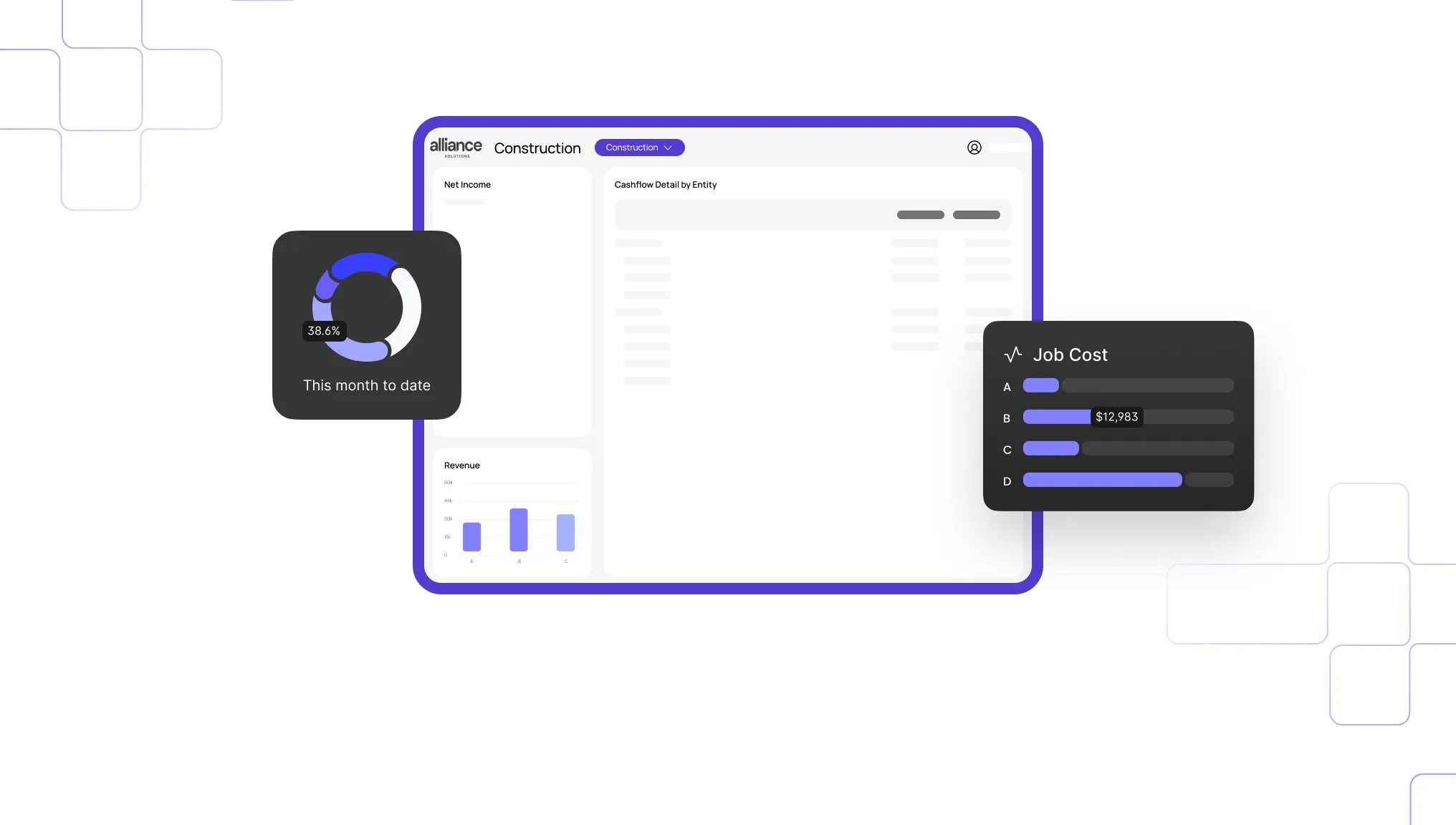

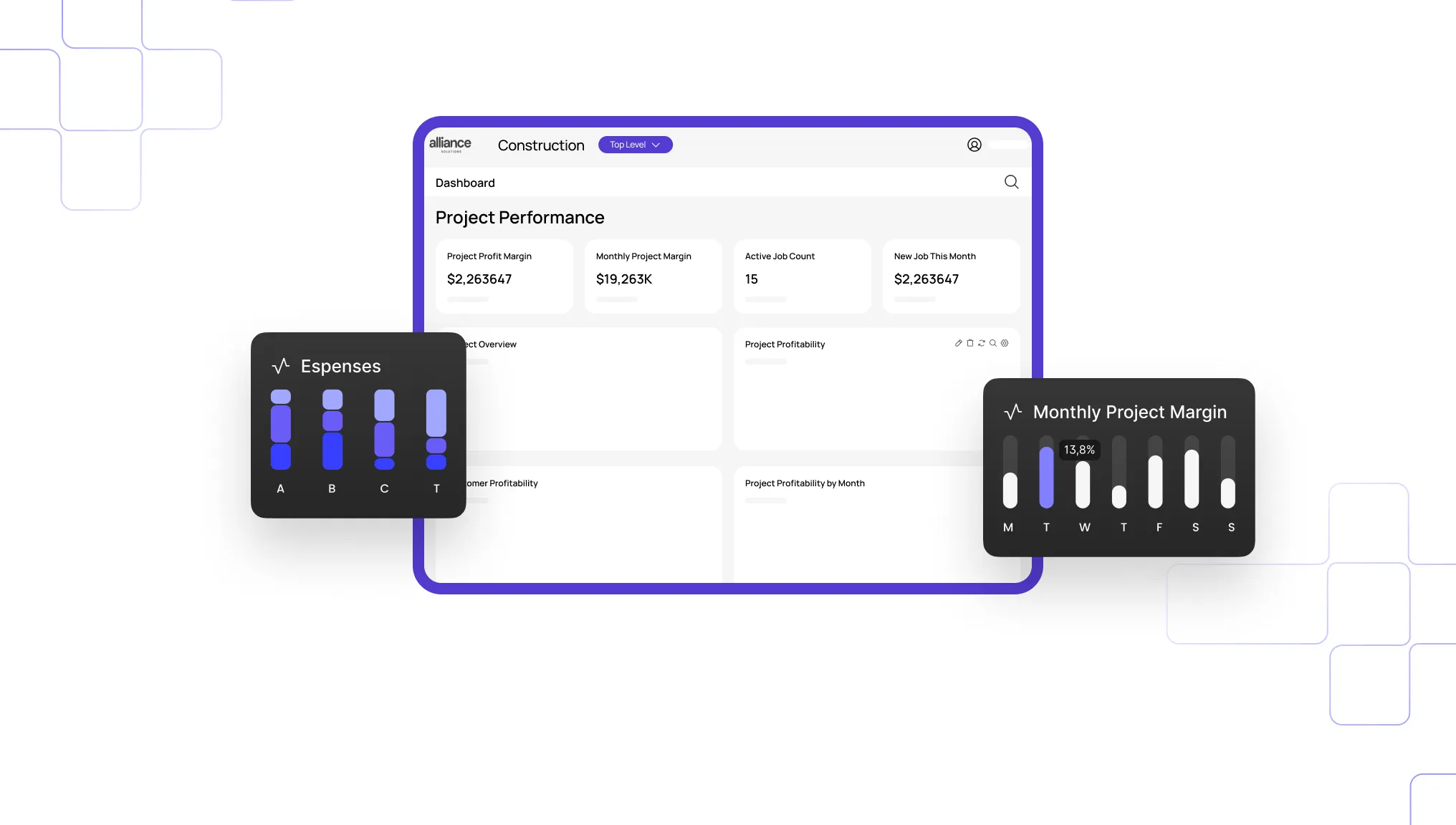

Financial Management

profitability.

Automate billing, payroll, and WIP reports — and reduce

your reliance on clunky spreadsheets for good.

.jpg)

.png)

Trusted by the trades.

Fit for firms like yours.

The premier partner for

Sage Intacct Construction.

Dive into Alliance's recent blog posts.

Alliance Solutions Group Appoints Dustin Stephens as Chief Executive Officer

SARASOTA, Florida — January 16, 2026 — Alliance Solutions Group, a Sage-verified software reseller and operating company of Pine Services Group, announced the appointment of Dustin Stephens as Chief Executive Officer.

Stephens brings more than 30 years of experience in construction and construction technology, including 13 years at Sage, where he most recently served as Vice President of Construction and Real Estate. His deep understanding of the Sage ecosystem, construction customers, and partner landscape uniquely positions him to lead Alliance through its next phase of growth.

Founder and former CEO Michael Griffith has transitioned into the role of Chairman, continuing to support Alliance’s leadership and long-term vision. Under Stephens’ leadership, Alliance will remain focused on helping construction and real estate organizations modernize operations, improve financial visibility, and achieve measurable business outcomes through technology.

👉 Read the full press release here.

Book a Demo with Alliance Solutions Group

Take a Sage Intacct Product Tour

Strengthen visibility. Improve accuracy. Build a scalable financial foundation.

.webp)

How Electrical Contractors Can Strengthen Bonding Capacity Through Smarter WIP Reporting

For electrical contractors, bonding capacity is often the constraint that determines which projects you can chase and which ones stay out of reach. What many contractors don’t realize is that the single most powerful document influencing bonding capacity is not the audited financials, not the bank line, and not even the contractor questionnaire.

It’s your Work-in-Progress (WIP) report.

A clean, accurate WIP tells a story of control, predictability, and financial strength. In the current environment, where underwriters are tightening standards and scrutinizing construction firms more closely than they have in years, this difference matters.

Here’s how smarter WIP reporting can immediately strengthen your bonding profile and how electrical contractors can get there.

What Sureties See When They Look at Your WIP

WIP as the Surety’s Project Scorecard

While your team uses WIP to understand job status, sureties use it as a direct indicator of operational discipline. A WIP schedule shows:

- Original contract and the revised contract; accounting for change orders

- Estimated total cost and cost-to-date

- Revenue earned under percentage-of-completion

- Overbillings and underbillings

- Gross profit to date

An accurate WIP, along with CPA-prepared financials provide great insights to the health of the business. Sureties rely on these numbers to evaluate both job-level performance and overall backlog risk.

How WIP Connects to Bonding Capacity

Most bonding programs begin with adjusted working capital, which is allowable current assets minus current liabilities. But the multiplier a surety applies to that working capital, often 10 to 20 times for aggregate capacity, depends heavily on the quality of information in your WIP.

Underwriters often import your WIP into their own systems and trend performance across jobs. They look for:

- Predictability

- Margin stability

- Realistic cost-to-complete forecasts

- A backlog that your balance sheet can support

A contractor with accurate, timely WIP reporting is inherently a lower-risk account.

The Red Flags Underwriters Spot in WIP Reports

Underwriters look for specific patterns in a WIP report that signal elevated risk. These are the red flags electrical contractors should watch for when evaluating their own reporting.

Late-Stage Underbillings

Underbillings happen when you’ve earned revenue but haven’t billed it yet. Some underbilling is normal; however, significant underbillings on jobs that are 85-90% complete stand out as a major risk indicator.

Why it matters:

- They often signal unapproved change orders or disputes.

- Collection is uncertain, so sureties may discount those amounts.

- Discounted underbillings reduce working capital, which directly reduces bonding capacity.

Electrical contractors face this risk frequently because of design changes, coordination issues, and material-driven billing constraints.

Profit Fade Across Jobs

Sureties closely track whether job margins hold from bid to completion. Consistent margin decline (known as profit fade) raises concerns about:

- Estimating accuracy

- Job cost visibility

- Change-order discipline

- The contractor’s willingness to confront issues early

One fading job can be explained. A fading portfolio signals structural problems and limits how far a surety is willing to stretch your bonding line.

Billing and Cash-Flow Signals

Underwriters pay close attention to:

- Chronic underbillings, which strain cash and suggest slow billing or unresolved scope issues

- Overbillings that do not tie to cash or receivables, which may indicate job borrowing or cash stress

Outdated or Inconsistent WIP

A WIP schedule that is outdated, rushed, or does not reconcile to the general ledger undermines credibility. Underwriters expect:

- Updated WIP at least quarterly

- Clear tie-out between WIP, financials, and backlog

- Accurate retainage treatment

- No Excel-only schedules that conflict with the accounting system

How Electrical Contractors Can Turn WIP Into a Bonding Asset

Increasing bonding capacity has little to do with volume and everything to do with accuracy. Contractors strengthen their position by delivering reliable information on a consistent basis.

Build a Monthly WIP Cadence

High-performing contractors have a predictable rhythm:

- PMs or project accountants provide monthly cost-to-complete updates

- Accounting validates percent complete and earned revenue

- Leadership reviews margin movement and red flags

This cadence gives you accurate reporting and gives your agent and surety confidence that the numbers reflect reality.

Reduce Profit Fade Through Better Forecasting and Change Control

You strengthen your bonding position when your WIP demonstrates control. To do that:

- Start projects with conservative margins

- Document why margins change and adjust WIP in real time

- Follow a disciplined change-order workflow

- Avoid end-of-job write-downs, which signal delayed recognition of issues

Strengthen Working Capital by Improving A/R Quality

Sureties commonly discount A/R older than 90 days, unless clearly identified as retainage. To protect working capital:

- Break out retainage separately

- Address old receivables aggressively

- Prepare “subsequent collections” documentation for renewals

- Resolve disputes proactively

Cleaner A/R = stronger working capital = stronger bonding capacity.

Replace Spreadsheets with Construction-Focused WIP in Sage Intacct

One of the most common barriers to bonding support is a WIP schedule that relies on spreadsheets or contains inconsistent data.

Electrical contractors benefit from moving to systems like Sage Intacct Construction, which:

- Automates percentage-of-completion revenue recognition

- Produces WIP, job cost, and financials from one source of truth

- Tracks retainage properly

- Posts and reverses over/under billing accruals automatically

- Provides WIP history that mirrors how sureties trend your jobs

Quick “Bond-Ready WIP” Checklist

A WIP schedule that supports bonding capacity should:

- Be updated monthly internally and quarterly for your surety

- Reconcile cleanly to financial statements

- Explain major margin movements

- Show minimal late-stage underbillings

- Reflect stable or improving job profitability

- Be produced from a construction system—not spreadsheets

- Give your bond agent confidence to advocate for you

When your WIP tells a clear and consistent story, your bonding capacity grows with it.

Strengthen Your Bonding Position With Alliance + Sage Intacct Construction

Accurate, real-time WIP reporting gives electrical contractors a clear advantage by improving financial visibility, strengthening surety confidence, and supporting larger bonded work. Alliance helps contractors build the systems and reporting structure underwriters trust. If improving your WIP process or expanding bonding capacity is a priority, our team is ready to help.

Schedule a consultation to explore how Sage Intacct Construction can support your goals.

Hear It Directly From the Surety Side

Understanding how sureties interpret your WIP is one thing. Hearing it explained by the people who evaluate contractors every day is another. Our recent webinar brought together construction financial experts and seasoned surety specialists to break down how underwriters assess risk, what they look for inside your WIP, and how contractors can strengthen their position before they request their next bond.

If you want a clearer picture of how your reporting influences real bonding decisions, this conversation is an excellent next step.

Beyond Spreadsheets: How Real-Time Construction Accounting Builds Surety Confidence

For many electrical contractors, the biggest obstacle to growth is not the work itself, it’s the ability to secure the bonding support required to pursue larger or more profitable jobs. Your WIP tells a story. Make sure it’s the right one. Sureties are willing to extend significant capacity, but only when the contractor demonstrates accuracy, consistency, and financial transparency.

This is where Work-in-Progress (WIP) reporting plays a defining role. A WIP schedule that ties directly to the balance sheet and income statement signals strength and control. A WIP built on spreadsheets, disconnected systems, and manual adjustments does the opposite.

Contractors who want to build stronger surety relationships need more than effort. They need real-time, integrated construction accounting that eliminates the uncertainty sureties see in spreadsheet-driven reporting.

Why WIP Quality Shapes Surety Confidence

Sureties review a contractor’s WIP as a primary indicator of operational discipline. The WIP reveals how projects are performing, how cash is managed, and whether margins are holding or fading as work progresses.

A standard WIP schedule includes core elements that help underwriters evaluate job health:

- Contract value

- Estimated cost and cost to date

- Percent complete

- Earned revenue

- Billings to date

- Over and under billings

- Gross profit to date

When these figures are accurate and tied to the contractor’s financial statements, they give sureties a clear and trustworthy picture of performance. When the information is inconsistent or outdated, the credibility of the entire submission suffers.

Where Spreadsheets and QuickBooks Create Risk

Many electrical contractors rely on a mix of QuickBooks and Excel to prepare their WIP schedule. While this approach may work early in the company’s lifecycle, it introduces structural weaknesses that sureties notice immediately.

QuickBooks cannot generate a true percentage-of-completion WIP

Because QuickBooks does not produce a WIP schedule that uses percentage-of-completion calculations, contractors must build their WIP manually in Excel. The WIP then becomes a standalone document that does not tie directly to the financial statements, which forces underwriters to question whether the numbers are complete and accurate.

Retainage is buried inside the A/R aging

QuickBooks does not separate retainage from normal receivables. Sureties often discount receivables older than 90 days unless they are clearly identified as retainage. When the system cannot distinguish between the two, contractors lose working capital credit that affects bonding capacity.

Manual spreadsheets increase the likelihood of errors

Spreadsheet WIP schedules often contain outdated information, broken formulas, or missing jobs. Even small inaccuracies undermine confidence because sureties rely on WIP to assess backlog, cost-to-complete, and margin trends.

WIP does not tie cleanly to the balance sheet and income statement

Underwriters expect over and under billings, earned revenue, and gross profit to match the contractor’s financials. When WIP data lives outside the accounting system, the tie-out becomes a manual and error-prone exercise. Any inconsistency creates doubt about financial reliability.

The result is a fragmented financial story

A contractor may have strong operational performance, but if the WIP, income statement, and balance sheet do not align, the surety sees risk rather than strength. This often limits capacity and slows approvals.

How Real-Time Construction Accounting Replaces Uncertainty with Clarity

Modern construction accounting platforms solve these limitations by creating one unified source of truth for job cost, WIP, and financial reporting. When WIP ties directly to the general ledger, sureties see the consistency and transparency they expect.

WIP, financials, and job cost all align automatically

Integrated systems calculate percent complete, earned revenue, and over and under billings using real job-cost data. These values post directly to the general ledger, which ensures that financial statements always match the WIP schedule without manual reconciliation.

Retainage is handled correctly

Construction-focused platforms record retainage separately from receivables and payables. This gives sureties a clear view of what is collectible and prevents unnecessary discounts from working capital.

Real-time updates reduce margin surprises

Project managers can update cost forecasts at any time. Leadership can view performance dashboards daily. Accounting can generate WIP on demand rather than waiting for period close. This allows contractors to identify issues earlier and strengthens predictability across the backlog.

Consistent WIP cadence builds trust

With automated WIP calculations, contractors can provide monthly internal WIP and quarterly WIP for sureties with minimal effort. A consistent rhythm gives underwriters confidence that the numbers reflect current conditions, not outdated information.

The financial story becomes straightforward and defensible

Sureties prefer a contractor whose financials, WIP, and backlog tell the same story without explanation. Integrated construction accounting makes that possible.

Why Real-Time Accounting Strengthens Bonding Outcomes

Real-time, accurate financial data reshapes how sureties evaluate your business and how confidently they extend support. Contractors who replace spreadsheets with integrated systems experience measurable improvements in the areas underwriters scrutinize most.

The Bonding Advantages of Real-Time Construction Accounting

1. Faster responses on new bonded opportunities

When WIP, financials, and job cost all reconcile automatically, agents have the confidence to move quickly. Contractors can pursue more work without delays caused by outdated or inconsistent reporting.

2. Stronger working-capital presentation

Clear retainage reporting and accurate cost-to-complete data allow underwriters to evaluate working capital with more precision. This clarity often results in a higher effective capacity because fewer assets are discounted.

3. Better visibility into margin stability

Sureties pay close attention to whether job margins hold or fade. Real-time forecasting and automated WIP updates help teams address issues early, which reduces margin surprises at closeout.

4. Improved premium positioning

The most competitive rates are typically reserved for contractors that demonstrate predictable performance and strong internal controls. Real-time accounting supports both, strengthening the overall risk profile presented to underwriters.

How Alliance Helps Electrical Contractors Move Beyond Spreadsheets

Alliance works with electrical contractors that want to modernize their WIP process, strengthen their financial reporting, and improve surety confidence. Our team helps contractors:

- Evaluate their current WIP and financial process

- Identify gaps that create uncertainty or slow underwriting

- Implement Sage Intacct Construction with a workflow built around surety expectations

- Train teams to maintain accurate, timely job and financial data

- Produce WIP schedules that tie directly to the general ledger

By moving to real-time construction accounting, contractors replace spreadsheet risk with financial clarity that supports larger bonding programs and greater growth potential.

The Path Forward: Building a Bond-Ready Financial Foundation

Electrical contractors do not lose bonding opportunities because they lack capability. They lose opportunities when their financial information creates questions that underwriters cannot resolve. QuickBooks and spreadsheets make financial clarity difficult to achieve. Integrated, real-time construction accounting removes that barrier.

When your WIP, balance sheet, and income statement align naturally, sureties gain confidence, bonding capacity expands, and your business can pursue the work it is built for.

Reach out to explore how real-time construction accounting can support your goals.

Hear It Directly From the Surety Side

Understanding why spreadsheets and basic accounting tools create friction with sureties is valuable. Hearing it explained by the people who review contractor financials every day is even more powerful. In our recent webinar, construction finance leaders and surety specialists walked through the exact reporting gaps that slow underwriting, why tie-out between WIP and financials matters so much, and how real-time construction accounting changes the entire bonding conversation.

If you want to see what sureties identify as risk and what gives them confidence when reviewing a contractor’s submission, this discussion is the ideal next step.

.webp)